David decided to sell his business on a Tuesday morning in March. By Friday, he'd hired a broker and listed his $4.2M company.

Six months later, he finally accepted an offer—for $2.8M. That's $1.4 million less than he expected. Why?

His books were a mess (took 3 months to clean up, lost buyer momentum)

His top customer represented 42% of revenue (buyers walked away)

His lease had 18 months remaining (landlord wouldn't extend)

He had no documented systems (buyers saw massive risk)

His management team was weak (no one could run it without him)

Every single one of these issues was fixable. But each one required 12-24 months to address properly. David didn't have that time because he listed immediately.

He left $1.4 million on the table because he didn't know one critical truth: Preparing your business for sale isn't a six-month project—it's a three-year transformation.

Over the past eight articles, I've shown you the six pillars of business transferability. Today, I'm giving you the exact timeline for implementing everything—so you don't make David's mistake.

Why Three Years? The Reality of Business Transformation

Most business owners dramatically underestimate how long meaningful change takes:

What Needs to Change | Owner Thinks | Reality |

|---|---|---|

Clean up financials | 3 months | 12-18 months to establish clean track record |

Reduce customer concentration | 6 months | 18-36 months to diversify meaningfully |

Build management team | 6 months | 24-36 months to hire, train, and prove capability |

Document systems | 3 months | 12-18 months to document, test, and refine |

Remove owner dependency | 6 months | 24-36 months to truly become expendable |

Renegotiate lease | 1 month | 6-24 months (timing dependent on renewal dates) |

The truth: You can make cosmetic changes in 6 months. Real, buyer-convincing transformation takes 3 years.

THE CRITICAL INSIGHT: Buyers don't just want to see that you've made improvements—they want to see that those improvements are sustainable over time. That's why they look at 3-5 years of financial history. One good year doesn't prove anything. Three consecutive years of improvement? That's a trend they can trust.

Your Current Situation: Which Timeline Are You On?

Before we dive into the roadmap, let's assess where you are:

If You're Planning to Sell in 3+ Years:

Perfect timing. You have time to implement everything methodically, prove the results, and maximize your value. Follow the complete 36-month roadmap below.

If You're Planning to Sell in 12-24 Months:

Tight but doable. You'll need to prioritize ruthlessly and work on multiple fronts simultaneously. Focus on the highest-impact items and be prepared for intense effort. Some improvements won't be fully proven, but you can show progress.

If You're Planning to Sell in 6-12 Months:

Challenging. You won't be able to address everything. Focus on fixing deal-killers (legal issues, financial cleanup) and documenting what exists. Accept that you'll likely get a lower multiple than if you'd started earlier.

If You Want to Sell Right Now:

Sell as-is or wait. You have two choices: (1) Accept current market value for your business in its current state, or (2) Delay the sale 18-36 months and do this properly. There's no magic wand.

The Complete 36-Month Exit Preparation Timeline

Here's your comprehensive roadmap, organized into six-month phases:

MONTHS 36-30: Assessment and Foundation (Year 3 Begins)

Primary Goal: Understand where you are and create your improvement roadmap

Key Activities:

1. Complete Comprehensive Business Assessment

Engage M&A advisor or business broker for preliminary valuation

Complete business transferability assessment across all six pillars

Identify gaps between current state and sellable state

Estimate current business value vs. optimized value

Calculate potential value increase from improvements

2. Assemble Your Advisory Team

M&A attorney (not your general business attorney)

CPA experienced in business sales

Business broker or M&A advisor

Financial advisor for personal exit planning

Insurance advisor to review coverage

3. Conduct Financial Audit

Review 3 years of financials for issues

Separate personal and business expenses completely

Identify add-backs and document them

Switch to accrual accounting if using cash basis

Engage CPA to prepare for clean financial track record going forward

4. Legal Infrastructure Audit

Review all contracts for change-of-control provisions

Check lease terms and transferability

Verify all licenses and permits are current

Confirm intellectual property ownership

Identify legal issues requiring long-term resolution

5. Set Specific Exit Goals

Target sale date (Month 36 from now)

Desired sale price and terms

Post-sale involvement preferences

Deal structure preferences

Personal financial requirements

Investment This Phase: $15,000-$30,000 (advisors, assessments)

Time Commitment: 20-30 hours (mostly meetings and information gathering)

MONTHS 30-24: Strategic Planning and Major Hires (Year 3)

Primary Goal: Create detailed improvement plan and make first major hires

Key Activities:

1. Build Your Management Team - Phase 1

Hire or promote General Manager/Operations Manager (your first key hire)

Begin delegating daily operations systematically

Document your current role and responsibilities

Create transition plan for moving into strategic role

Start building organizational chart with clear reporting lines

2. Begin Customer Diversification

Analyze customer concentration and identify risk

Set specific diversification targets (no customer over 15%)

Implement systematic marketing and lead generation

Launch customer acquisition campaigns

Track concentration metrics monthly

3. Financial Systems Implementation

Implement proper accounting software if not already done

Establish monthly close procedures

Create financial dashboard with key metrics

Begin tracking adjusted EBITDA monthly

Separate all personal expenses from business

4. Start Systems Documentation

Create master list of all business processes

Prioritize processes by criticality

Choose documentation tool/platform

Begin documenting top 10 most critical processes

Assign process owners

5. Address Legal Issues

Begin renegotiating unfavorable contracts

Start lease renewal discussions if needed

Resolve any pending disputes or litigation

File trademark applications if not already done

Create timeline for resolving each legal issue identified

Investment This Phase: $40,000-$80,000 (first management hire, legal fees, systems)

Time Commitment: 10-15 hours/week

MONTHS 24-18: Deep Implementation (Year 2-3 Transition)

Primary Goal: Execute major improvements and establish new patterns

Key Activities:

1. Expand Management Team

Add Sales Manager or Controller (second key hire)

Implement regular management team meetings

Delegate major decision-making authority

Create management development program

Begin succession planning documentation

2. Aggressive Customer Acquisition

Add 20-30 new customers to dilute concentration

Implement referral program

Launch systematic business development

Build marketing systems for consistent lead flow

Track and celebrate concentration reduction progress

3. Systems Documentation Sprint

Complete 30-50 core SOPs

Test all procedures with new team members

Refine based on testing feedback

Create training program based on SOPs

Begin compiling operations manual

4. Owner Independence Acceleration

Reduce involvement to 30-40 hours/week

Transfer all customer relationships to team members

Stop personally closing new sales (train others)

Take 2-3 week vacation to test systems

Document any issues that arose during absence

5. Brand Development

Professional logo and brand identity (if needed)

Website redesign (modern, mobile-responsive)

Begin systematic review generation

Create brand style guide

Ensure all assets owned by business, not personally

Investment This Phase: $50,000-$100,000 (additional hires, marketing, brand development)

Time Commitment: 15-20 hours/week initially, decreasing to 10-15 hours/week

MONTHS 18-12: Proof and Optimization (Year 2)

Primary Goal: Prove improvements are sustainable; optimize operations

Key Activities:

1. Management Team Maturation

Complete management team with all key roles filled

Implement performance-based compensation

Begin discussing retention agreements

Document management team capabilities and track record

Owner reduces to 20-30 hours/week

2. Customer Concentration Achievement

Reach target: No customer over 15%, top 5 under 40%

Implement customer retention program

Build recurring revenue streams where possible

Document customer acquisition systems

Show consistent new customer growth

3. Financial Performance Optimization

Focus on improving EBITDA margins

Implement cost optimization initiatives

Create 3-year financial trend showing growth

Prepare comprehensive add-back documentation

Consider QofE report if revenue over $5M

4. Complete Systems Documentation

Finish documenting all major processes (60-80 SOPs)

Create complete operations manual

Implement continuous improvement process

Make SOP training part of onboarding

Update documentation quarterly

5. Legal Clean-Up Completion

All contracts reviewed and updated

Lease renewed with favorable transfer terms

All licenses and permits current and documented

IP protection complete (trademarks registered)

No pending litigation or disputes

Investment This Phase: $30,000-$60,000 (team completion, optimization, legal finalization)

Time Commitment: 10-15 hours/week

MONTHS 12-9: Pre-Market Preparation (Year 1-2 Transition)

Primary Goal: Prepare all materials for going to market

Key Activities:

1. Valuation and Positioning

Obtain professional business valuation

Understand value drivers and multiples for your industry

Set realistic asking price based on valuation

Identify target buyer types

Create buyer-specific positioning strategies

2. Financial Package Preparation

Prepare 3-5 year financial statements

Create detailed add-back schedule with documentation

Reconcile tax returns to financial statements

Prepare normalized EBITDA analysis

Have CPA review all financial documentation

3. Retention Agreements

Finalize retention bonus structures for key employees

Execute retention agreements (payable at/after closing)

Communicate with team about upcoming sale process

Address team concerns and maintain morale

Document management team stability

4. Documentation Package Assembly

Organize all legal documents

Compile operations manual

Create customer and vendor lists

Prepare employee roster and org chart

Gather insurance policies and contracts

Set up virtual data room

5. Marketing Materials Creation

Professional confidential information memorandum (CIM)

Executive summary (teaser document)

Financial presentation package

Investment highlights summary

Photos and visual assets

Investment This Phase: $20,000-$40,000 (valuation, CIM creation, documentation preparation)

Time Commitment: 10-15 hours/week

MONTHS 9-6: Market Preparation and Buyer Identification (Year 1)

Primary Goal: Finalize positioning and identify potential buyers

Key Activities:

1. Broker/Advisor Selection

Interview 3-5 business brokers or M&A advisors

Check references and track records

Understand fee structures and services

Select representation and execute listing agreement

Align on strategy, pricing, and timeline

2. Buyer List Development

Identify strategic buyers (competitors, suppliers, customers)

Research private equity firms in your sector

Identify potential individual buyers

Research international buyers seeking US entry

Create confidential buyer contact strategy

3. Final Business Optimization

Address any remaining value detractors

Maximize EBITDA in final months before listing

Ensure facility and equipment are presentable

Update all marketing and brand materials

Confirm all legal/regulatory compliance

4. Owner Transition Readiness

Reduce involvement to 10-20 hours/week

Prove business runs without significant owner involvement

Take 30-day "test absence" to demonstrate independence

Document that business maintained/grew during absence

Prepare for answering buyer questions about role

5. Team Communication and Preparation

Brief management team on sale process timeline

Prepare them for buyer meetings and questions

Reinforce retention agreements and their benefits

Address concerns about new ownership

Maintain business momentum and morale

Investment This Phase: $15,000-$30,000 (broker retainer, final optimizations)

Time Commitment: 10-15 hours/week

MONTHS 6-3: Marketing and Buyer Outreach (Year 1)

Primary Goal: Generate qualified buyer interest and begin preliminary discussions

Key Activities:

1. Go to Market

List business on appropriate marketplaces (BizBuySell, etc.)

Distribute teaser to qualified buyer prospects

Begin confidential outreach to strategic buyers

Manage NDAs and information distribution

Track buyer inquiries and qualification

2. Buyer Qualification and Screening

Screen buyers for financial capability

Assess buyer fit and seriousness

Distribute CIM to qualified buyers

Answer initial buyer questions

Schedule facility tours for serious buyers

3. Business Performance Maintenance

Keep business performing at high level

Don't let sale distraction impact operations

Continue customer acquisition and retention

Maintain team morale and focus

Update financials monthly for buyer questions

4. Preliminary Negotiations

Receive and evaluate Letters of Intent (LOIs)

Compare offers across price, terms, certainty, fit

Negotiate key terms before accepting LOI

Create competition among buyers if multiple interested

Engage attorney to review LOI terms

5. Due Diligence Preparation

Organize virtual data room with all documentation

Prepare for detailed buyer questions

Brief management team on due diligence process

Engage transaction team (attorney, CPA, advisor)

Prepare for intensive buyer scrutiny

Investment This Phase: $10,000-$25,000 (marketing, legal fees)

Time Commitment: 15-25 hours/week (buyer meetings, questions)

MONTHS 3-0: Due Diligence and Closing (Final Quarter)

Primary Goal: Complete due diligence, finalize terms, and close transaction

Key Activities:

1. Due Diligence Management

Respond to comprehensive buyer information requests

Provide access to facilities, systems, and team

Facilitate buyer meetings with management, customers, vendors

Address buyer concerns and questions promptly

Keep transaction momentum going

2. Final Negotiations

Negotiate purchase agreement terms

Finalize price and deal structure

Agree on working capital requirements

Settle representations and warranties

Negotiate indemnification terms

Finalize transition services agreement

3. Team and Stakeholder Communication

Inform team of pending sale (if not already done)

Communicate with key customers (with buyer agreement)

Notify vendors and partners as appropriate

Manage landlord consent process

Address team concerns about new ownership

4. Closing Preparation

Review and finalize all transaction documents

Coordinate with lenders (buyer's financing)

Prepare closing statement and funds flow

Resolve final issues and conditions

Schedule closing date and logistics

5. Closing and Transition

Execute all closing documents

Transfer assets and ownership

Receive proceeds

Begin transition services to buyer

Support new owner during handoff period

Investment This Phase: $25,000-$75,000 (legal fees, transaction costs)

Time Commitment: 20-40 hours/week during due diligence and closing

Total Investment and ROI Summary

Phase | Investment | Time |

|---|---|---|

Months 36-30: Assessment | $15,000-$30,000 | 20-30 hours total |

Months 30-24: Planning & Hires | $40,000-$80,000 | 240-360 hours (10-15/wk × 24 weeks) |

Months 24-18: Implementation | $50,000-$100,000 | 360-480 hours (15-20/wk × 24 weeks) |

Months 18-12: Proof & Optimization | $30,000-$60,000 | 240-360 hours (10-15/wk × 24 weeks) |

Months 12-9: Pre-Market Prep | $20,000-$40,000 | 120-180 hours (10-15/wk × 12 weeks) |

Months 9-6: Market Prep | $15,000-$30,000 | 120-180 hours (10-15/wk × 12 weeks) |

Months 6-3: Marketing | $10,000-$25,000 | 180-300 hours (15-25/wk × 12 weeks) |

Months 3-0: Due Diligence & Close | $25,000-$75,000 | 240-480 hours (20-40/wk × 12 weeks) |

TOTAL 36-MONTH INVESTMENT | $205,000-$440,000 | 1,520-2,370 hours |

RETURN ON INVESTMENT:

Based on hundreds of transactions, proper 3-year preparation typically increases sale price by:

Minimum: 30-50% ($600K-$1M on a $2M business)

Average: 50-100% ($1M-$2M on a $2M business)

Best case: 100-200% ($2M-$4M on a $2M business)

ROI on $440K investment: 2x to 10x

Plus: The business is more profitable and easier to run during the preparation period, often generating additional income that offsets the investment.

Shortened Timelines: What If You Don't Have 3 Years?

The 18-Month Accelerated Plan

What you CAN accomplish:

Clean up financials (12 months of clean track record)

Document major systems and processes

Make 1-2 key management hires

Address critical legal issues

Reduce owner involvement significantly

Begin customer diversification (partial progress)

What you likely CAN'T accomplish:

Fully diversified customer base (not enough time)

Complete management team with proven track record

Three years of financial trends showing improvement

Total owner independence (can reduce but not eliminate)

Expected impact: 20-40% increase in value vs. selling immediately

The 12-Month Emergency Plan

Focus ONLY on:

Financial cleanup (essential for any sale)

Critical legal issues that would kill deals

Basic systems documentation

Fixing obvious red flags

Accept that you'll:

Get lower multiples than with more preparation

Have smaller buyer pool (many will pass)

Face more buyer objections and pushback

Possibly need seller financing to close gaps

Expected impact: 10-25% increase vs. selling with zero preparation

THE HARD TRUTH: If you're thinking "I'll just sell as-is," understand that you're likely leaving 40-100% of your potential value on the table. On a $2M business, that's $800K to $2M you're walking away from. Is that worth rushing?

Your Personalized Timeline: Creating Your Roadmap

Use this framework to create your specific plan:

Set your target sale date (realistically 24-36 months out)

Assess your starting point:

Rate yourself 1-10 on each of the six pillars we've covered

Identify your biggest gaps (these need longest lead time)

Prioritize improvements by impact and timeline:

High impact + Long timeline = Start immediately

High impact + Short timeline = Start 12-18 months before sale

Low impact = Possibly skip if short on time

Create quarterly milestones:

What must be completed each quarter?

What resources (money, time, people) are required?

How will you measure progress?

Schedule monthly check-ins:

Review progress against timeline

Adjust plan based on results

Celebrate wins and address challenges

Build accountability:

Share plan with your advisory team

Create consequences for missing milestones

Consider engaging a coach or advisor for accountability

Common Timeline Mistakes to Avoid

Mistake #1: Underestimating Time Requirements

Reality: Everything takes longer than you think. Build 20-30% buffer into all timelines.

Mistake #2: Trying to Do Everything Simultaneously

Reality: Some things must be sequential. You can't prove owner independence until you've built a management team. Prioritize the sequential items.

Mistake #3: Stopping Too Early

Reality: You need 12-18 months of proven results AFTER making changes. One good quarter doesn't convince buyers.

Mistake #4: Neglecting Business Performance

Reality: While preparing for exit, you still need to run a profitable business. Don't let preparation distract from performance.

Mistake #5: Waiting for "Perfect"

Reality: Your business will never be perfect. At some point, "good enough" is truly good enough. Don't let perfectionism delay your exit indefinitely.

Your Action Items This Week

Set your target sale date: When do you realistically want to sell? Count backward 36 months—that's when preparation should start.

Complete the Six-Pillar Assessment: Rate yourself 1-10 on:

Owner Independence

Systems & Processes

Clean Financials

Customer Diversification

Management Team

Brand & Legal Infrastructure

Identify your top 3 gaps: What are the biggest weaknesses that will hurt your sale?

Calculate your potential value increase: What could your business be worth with proper preparation vs. today?

Schedule advisory team meetings: Engage professionals to help build your specific roadmap.

Block preparation time: Add weekly "exit preparation" time blocks to your calendar for the next 36 months.

Commit or don't: Either commit to doing this properly over 2-3 years, or accept that you'll get less when you sell. Half-measures waste time and money.

Coming Next: Article #10 – Common Mistakes That Destroy Business Value

In our final article of this series, I'll cover the costly mistakes that can undo all your preparation. You'll learn:

The top 15 mistakes that cost owners millions

How to avoid deal-killers during the sale process

Common negotiation mistakes sellers make

Why some deals fall apart at the finish line

How to protect yourself from buyer manipulation tactics

What to do (and not do) between LOI and closing

This is your final insurance policy—avoiding these mistakes could save you hundreds of thousands of dollars.

Remember: Building a sellable business isn't a sprint—it's a marathon. But it's a marathon with a multi-million dollar finish line. Start today, follow the roadmap, and give yourself the time to do it right.

Please help support this newsletter by simply clicking on the advertising link below and making sure you are subscribed to the newsletter. This is at no cost to you but helps offset the cost of bringing this information to you for FREE!

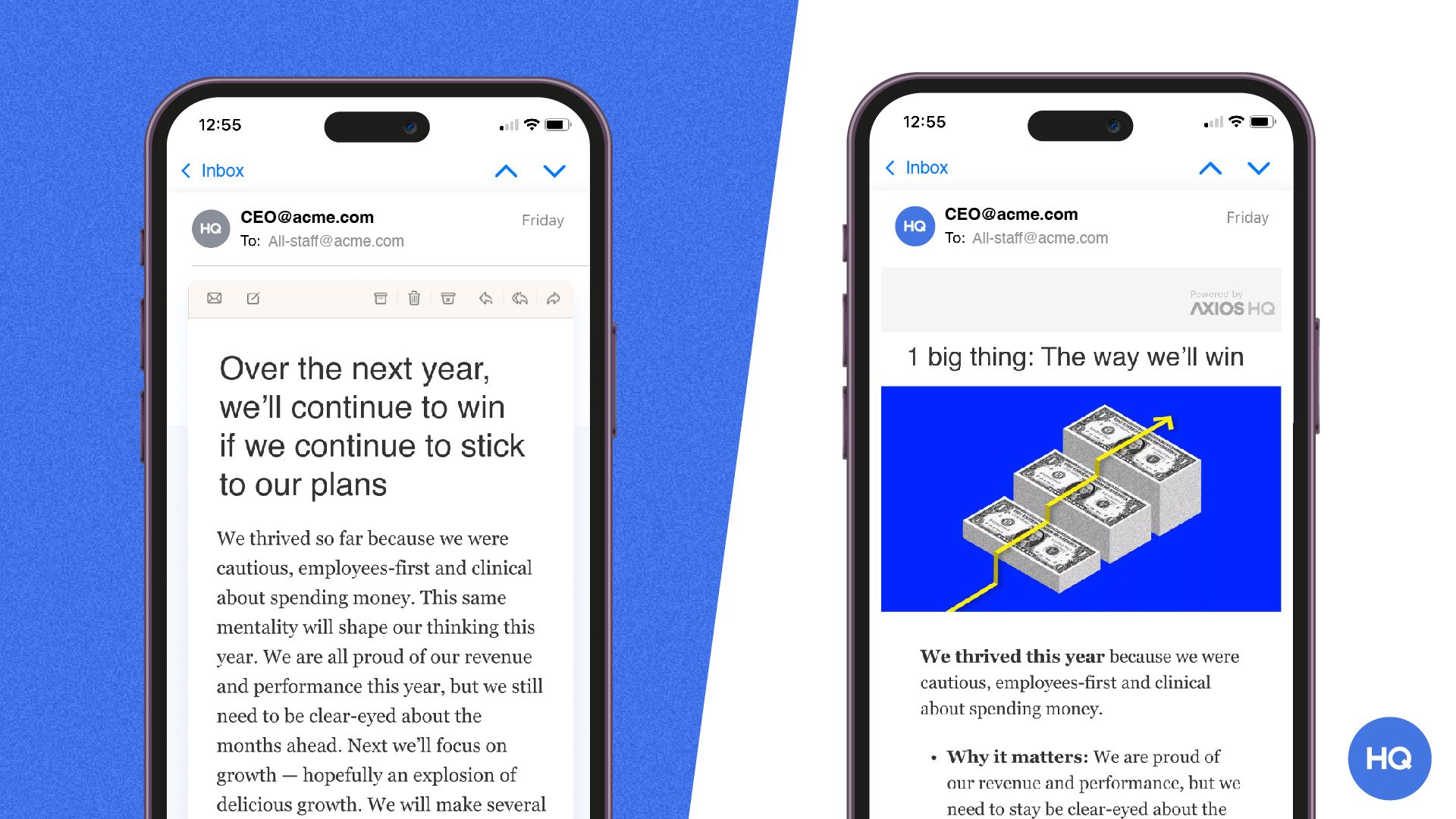

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

Book Shelf from Brett Vogeler: amazon.com/author/bvogeler

Need a roadmap? Reply in the comments section or send us an email for assistance. 360 Perspective Partners offers Professional Licensed Business, Commercial and Investment Brokerage Services along with providing Professional Licensed Community Management Services in Central Florida: https://my360perspective.com/

Contact me directly at [email protected]. To see our other useful Newsletters on this topic and others: https://realestate-business-broker-guru.beehiiv.com/

Stay ahead of the curve. Forward this to a colleague who needs to ride the wave and be sure to SUBSCRIBE for continued real estate and business content.