Brett Vogeler | Commercial Real Estate Intelligence

The Bottom Line Up Front: We're at an inflection point in industrial real estate. Vacancy has peaked near 7%, but the development pipeline has shrunk to 2016 levels. Smart money is positioning now for the tightening cycle ahead. Here's what you need to know to stay ahead of your competition.

Market Snapshot: The Numbers That Matter

The industrial sector is working through what I call a "mid-cycle normalization"—fancy talk for the market finding its footing after the pandemic boom-bust cycle. Here's where we stand:

Vacancy Reality Check: Different brokerages report vacancy between 6.6% (CBRE) and 7.5% (JLL), but they all agree on one thing—we're near the cyclical peak. More importantly, the supply pipeline has collapsed to just 241 million square feet under construction, the lowest level since 2016. Source: Multiple Market Reports

The Absorption Story: Net absorption tells two tales. CBRE shows a modest 3.5 MSF in Q2 (lowest since 2010) due to tenant consolidations, while Cushman & Wakefield reports a healthier 29.6 MSF. The truth? Leasing is happening, but companies are rightsizing footprints, creating a wash in net occupancy gains. Source: Market Analysis

The Game Changers: Who's Driving Demand

Third-Party Logistics (3PLs) Take the Lead

Here's the shift that matters: 3PLs signed 38 of the top 100 industrial leases in H1 2025, totaling 28.9 million square feet—up from 28 deals the year prior. Why? Retailers are outsourcing operations and rightsizing their own footprints. If you're not tracking 3PL activity in your market, you're missing the biggest demand driver. Source: DC Velocity

E-Commerce Hits Another Record

Q2 2025 online sales reached $304.2 billion—16.3% of total retail sales, a new record. That's up 5.3% year-over-year, maintaining the structural tailwind for modern warehouse demand even as retailers rationalize their footprints. Source: U.S. Census Bureau

Manufacturing Renaissance Continues

Real manufacturing construction spending has doubled since late 2021, supercharged by CHIPS Act, IRA, and “TRUMP Reshoring” infrastructure investments. Computer and electrical projects have nearly quadrupled. This isn't just about factories—it's creating demand for specialized industrial facilities around advanced manufacturing nodes. Source: U.S. Treasury

Regional Spotlight: Where the Action Is

Phoenix Turns the Corner: First vacancy decrease since 2022, down 30 basis points to 11.9%. Absorption hit 4.4 MSF with deliveries dropping sharply year-over-year. If you've been waiting for Phoenix to stabilize, this is your signal. Source: CBRE Phoenix Report

Inland Empire Stays Strong: Despite vacancy ticking to 6.7%, gross activity remained robust at 11.1 MSF in the core market. Several large build-to-suits broke ground, signaling continued confidence in the logistics capital of the West Coast.

Dallas-Fort Worth Delivers: 5.5 MSF quarterly absorption with vacancy down 30 basis points to 8.8%. Nearly half of recent deliveries came pre-leased—a healthy sign of demand-driven development.

Capital Markets: The Money Is Moving Again

After a brutal 2023-2024, H1 2025 industrial sales volume jumped ~12% compared to 2024 levels. Cap rates are holding in the 5% range with modest spreads based on asset quality and location. Translation: liquidity is returning, and if rates stabilize, expect Class A assets in prime locations to compress first. Source: Newmark Analysis

Technology & Sustainability: The New Competitive Edge

Warehouse Automation Boom: The global warehouse automation market is tracking toward $55 billion by 2030 (15% annual growth). This means higher specifications for power, floor loading, clear heights, and mezzanine-ready shells. If your properties can't support automation retrofits, they're falling behind.

Solar ROI Gets Real: CBRE Investment Management reports their solar programs are generating $707K+ in annual rental revenue and ~$136K in annual tenant utility savings across their U.S. portfolio. Properties with solar and efficiency upgrades are leasing faster than comparable assets. Source: CBRE Investment Management

What to Watch: Your Leading Indicators

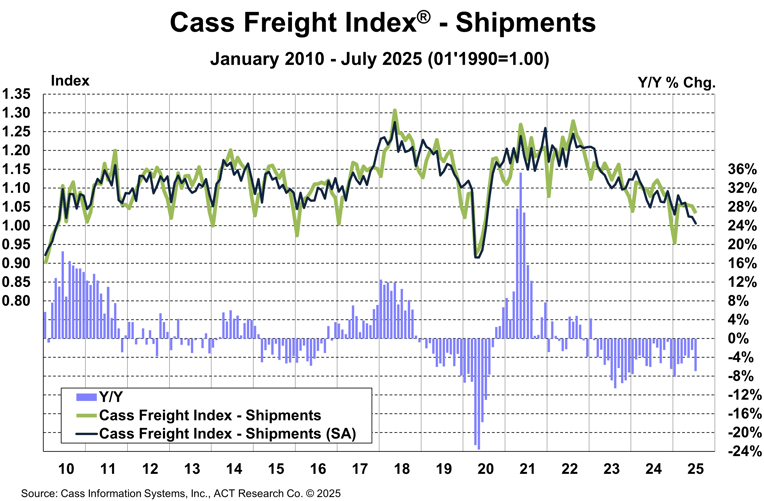

Freight Volumes: Cass Freight Index shipments fell 6.9% year-over-year in July—a near-term headwind for space absorption timing. Watch for re-acceleration as your early tell on stronger leasing activity. Source: Cass Information Systems

Construction Pipeline: At 241 MSF under construction (lowest since 2016), every quarter of weak starts increases the odds of a tighter 2026. The supply constraint story is real.

Policy Clarity: Tariff uncertainty remains the main brake on decision-making. Final rules could unlock delayed expansions and swing absorption scenarios significantly.

The 2025-2026 Outlook: Positioning for What's Next

Near-Term (H2 2025): Expect continued tenant-favorable conditions with modest concessions available, especially on larger footprints. NAIOP projects minimal absorption in H2 2025, while Prologis expects a 20% rebound as uncertainty clears.

2026 Setup: With the pipeline at decade lows and e-commerce/reshoring tailwinds intact, we're setting up for landlord-favorable conditions. Vacancy should peak in early 2025, then decline as supply constraints bite and flight-to-quality accelerates.

Your Action Plan by Role

Investors: The Accumulation Window is Open

Target Class A assets in supply-constrained infill and port-proximate submarkets while vacancy is near peak

Focus on smaller-bay or divisible assets where sub-100K SF users maintain tight conditions

Layer in solar/efficiency upgrades to drive NOI and leasing velocity

Expect cap rates in the 5s with best-in-class compressing first

Developers: Build Smart, Build Selective

Prioritize build-to-suit and high pre-lease thresholds for spec development

Design for automation: enhanced power, slab specs, clear heights, mezzanine-ready shells

Target cold storage and specialized manufacturing support in markets benefiting from the manufacturing boom

Consider sustainability features as competitive advantages, not just compliance items

Occupiers: Lock in Advantages Now

If you need high-throughput big boxes, this is your window for concessions

Negotiate power and sustainability options (rooftop solar, EV charging) to mitigate future operating costs

Tighten service-level KPIs with 3PL partners to balance flexibility with control

Consider automation-ready spaces even if not implementing immediately

Market Data at a Glance

Key Metrics | Q2 2025 | Trend |

|---|---|---|

National Vacancy | 6.6% - 7.5% | Near Peak |

Under Construction | 241 MSF | ↓ (2016 Low) |

E-commerce Share | 16.3% | ↑ Record High |

3PL Market Share | 38 of Top 100 Leases | ↑ Leading Demand |

Sales Volume H1 | +12% YoY | ↑ Recovery Mode |

Cap Rate Range | ~5% | → Stabilizing |

The Straight Shooting Bottom Line

The industrial market is in a mid-cycle reset, not a crisis. Demand fundamentals remain solid—driven by e-commerce growth, manufacturing reshoring, and 3PL expansion. Supply is finally moderating after years of overshooting.

Smart players are positioning now for the tightening cycle ahead. Whether you're buying, building, or leasing, the window for tenant-favorable conditions is narrowing. By mid-2025, expect the conversation to shift from "finding space" to "competing for space."

The winners will be those who act on quality assets with future-ready specifications while others wait for perfect clarity that never comes.

Questions about your specific market or property strategy? Let's talk. The data is clear—the opportunity window is defined. Your move.

Brett Vogeler specializes in commercial real estate brokerage and business transactions. This analysis is based on comprehensive market research from leading industry sources including CBRE, JLL, Cushman & Wakefield, Colliers, and government economic data. For specific investment advice, consult with qualified professionals.

Want the full research report with detailed regional breakdowns and additional charts? Access the complete Industrial Real Estate Research Dashboard here.

Please help support this newsletter by simply clicking on the advertising link below and making sure you are subscribed to the newsletter. This is at no cost to you but helps offset the cost of bringing this information to you for FREE!

Your daily edge in private markets

Wondering what’s the latest with crypto treasury companies, Pre-IPO venture secondaries, private credit deals and real estate moves? Join 100,000+ private market investors who get smarter every day with Alternative Investing Report, the industry's leading source for investing in alternative assets.

In your inbox by 9 AM ET, AIR is chock full of the latest insights, analysis and trends that are driving alts. Readers get a weekly investment pick to consider from a notable investor, plus special offers to join top private market platforms and managers.

And the best part? It’s totally free forever.

Book Shelf from Brett Vogeler: amazon.com/author/bvogeler

Need a roadmap? Reply in the comments section or send us an email for assistance. 360 Perspective Partners offers Professional Licensed Business, Commercial and Investment Brokerage Services along with providing Professional Licensed Community Management Services in Central Florida: https://my360perspective.com/

Contact me directly at [email protected]. To see our other useful Newsletters on this topic and others: https://realestate-business-broker-guru.beehiiv.com/

Stay ahead of the curve. Forward this to a colleague who needs to ride the wave and be sure to SUBSCRIBE for continued real estate and business content.

Sponsored

Money Masters

Money Masters Is Your Source For Money News.